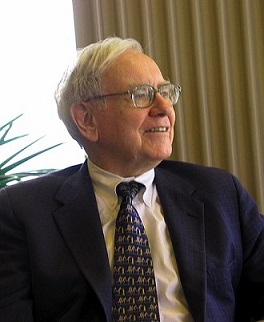

Warren Buffet courtesy of wikipedia.com

A friend emailed me recently. She wanted to increase her contribution to her IRA but her broker didn’t return her calls. What should she do? Well, since the market had dropped 2,000 points that day, I suggested she send him a box of chocolates.

Of course, no one should try to time the market. It runs on fear and gossip and guesswork. But if a stock is a good buy on one day, then drops a few dollars the next, no harm done. Over time, the stock is likely to grow in value. I’m not a gambler. I’m an investor.

Here’s what I mean. Recently, I bought a blue-chip stop for $6. It dropped to $5.00 the next day. Today, it’s $4.50. Normally, it sells in the $30 range. Currently, it pays a 10% dividend and, because the finances of the company are sound, I hope to collect that dividend while I wait for the market to steady itself. If in a year or two or three, the stock returns to its normal value, I might consider selling it to collect a profit.

At the moment, bonds don’t appear to be a safe place for money. There is talk of going to a negative interest rate. I bought some Treasuries several months ago at just over 2% interest. I wanted a little security for some cash. Right now that measly 2% looks pretty good, given the rate of inflation. But I won’t buy any more. Current rates look too iffy.

I want to remind my readers I’m not qualified as a financial adviser. What I’m sharing is from personal experience. It’s not advice. But if asked about investing, I’d say the first rule is never put money in the stock market which will be needed in the foreseeable future. After that, choose good companies that aren’t mired in debt and hold, hold, hold. Let time’s passage work for you. The strategy delivers for Warren Buffet. It should work for the rest of us.